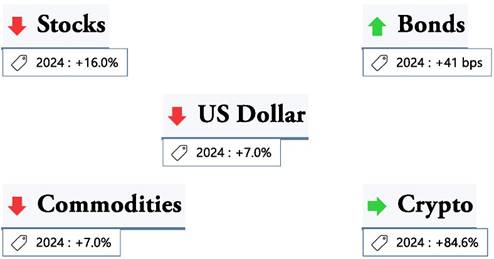

Bourstad stock market simulations - Summary of

the markets for the week ended on April 11, 2025

North American equities and commodities rise in final week of the 2025

Bourstad Challenge

North American equities and commodities rebounded in the final week of

the 2025 Bourstad Challenge. However, the week was highly volatile, as

evidenced by the VIX index, which ended the week at 37.6 after approaching 60

on Wednesday; normally, this index is below 15. In Canada, the number of

building permits fell by -7.1% between January and February 2025. The Bank of

Canada released two survey reports for the first quarter of 2025: the Business

Outlook Survey and the Canadian Survey of Consumer Expectations. Both show that

the U.S.-led trade war against Canada is having a significant negative impact

on business and consumer perceptions. In the U.S., the Consumer Price Index for

March 2025 was released, showing a -0.4% drop in the inflation rate to 2.4%

year-on-year for the full basket, and a -0.3% decline for the basket excluding

food and energy to 2.8% year-on-year. Over the coming week, we'll be watching:

in Canada, March manufacturing sales and inflation (Tuesday), and the Bank of

Canada's key rate decision (Wednesday); in the US, March retail sales and

industrial production (Wednesday), and March housing starts and building

permits (Thursday). Elsewhere in the world, we'll be paying attention to

China's first-quarter gross domestic product, Japan's consumer price index and

the European Central Bank's monetary policy meeting.

Three of the six stock markets we follow ended the week higher. The US

stock markets recorded the biggest gains, with the NASDAQ 100 jumping by 7.4%

and the New York Stock Exchange by 5.7%, although they were still the ones that

lost the most ground in the 2025 Bourstad Challenge. The Toronto Stock Exchange

rounded off the list of rising exchanges with a 1.7% rise. The Tokyo Stock

Exchange limited its losses to -0.6%. The Paris Bourse was down 2.3%, while the

Shanghai Stock Exchange lost 3.1%.

Yields on 10-year government bonds have risen sharply for three of the

four top-rated countries we track. Higher yields mean lower bond prices, given

the inverse relationship between yields and bond prices. U.S. bond yields, the

market's main benchmark, jumped 49 bps to 4.49% (1 basis point or bps = 0.01%).

The Canadian bond rate is also up sharply, by 38 bps, giving a Canadian rate

123 bps lower than the US rate. Germany's bond yield fell by ‑1 bps to

2.57%. Japan's bond yield rises by 19 bps to 1.35%.

On the commodities market, three of the four commodities we track are

up. Gold jumped 6.6% to close above 3,200 USD for the first time. Corn is also

up sharply, by 6.5%, after the US Department of Agriculture reduced the global

inventory of this grain by 75 million bushels. Copper is up 2.7% after a

reduction in production was observed in Chile in February. Only US oil was down,

by -0.8%.

In the crypto-currency sector, the two cryptos we follow are both down:

bitcoin by -0.2% and ethereum down sharply by -13.5%.

On April 11, it cost

3.5¢ CAD less to buy one US dollar than on April 4. The euro and yen are also

up sharply against Uncle Sam's dollar: the single European currency by 3.6% and

the Japanese currency by 2.4%.

See the detailed table by following this link:

https://iclf.ca/DL/BT25_sommaire_marches_250411.pdf

Paul Bourget

Project Director, Bourstad

CIRANO

paul.bourget@cirano.qc.ca

About CIRANO (www.cirano.qc.ca )

The Center for

Interuniversity Research and Analysis of Organizations (CIRANO) is a

multidisciplinary, liaison and transfer research center, whose mission is to

accelerate the transfer of knowledge between the research community and users

in industry and public services.

About BOURSTAD (www.bourstad.ca )

The Bourstad program

is an activity of the Center for Interuniversity Research and Analysis of

Organizations (CIRANO) which receives support from many partners for this

financial education project: the Autorité des marchés financiers, its main partner,

TD Bank, CFA Montreal , the Canadian Investment

Regulatory Organization (CIRO), Les Affaires, Finance Montreal, TMX Group,

Hyprasoft, Groupe Investissement responsable

and QuoteMedia.