Bourstad stock market simulations - Summary of

the markets for the week ended on April 18, 2025

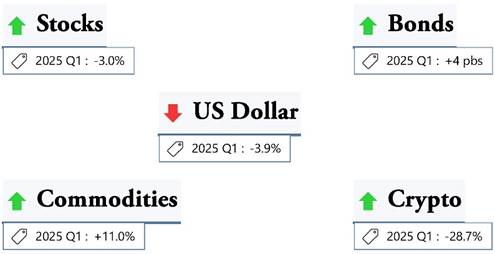

Only the US dollar down this week

Equities, bonds, commodities and crypto-currencies all ended the week

higher. In Canada, we noted the Bank of Canada's decision to leave its key rate

unchanged at 2.75%. Statistics Canada also published the inflation rate for

March, which stood at an annual rate of 2.3% for the full basket, down -0.3% on

the previous month; for the basket excluding food and energy, the rate was

2.8%, down -0.1% on February 2025. In the United States, retail sales rose by

1.4% in March, in line with economists' expectations. Also, the Federal Reserve

released statistics on industrial production, which declined by -0.3% in March

2025; these data also show that industrial capacity utilization fell over the

month from 78.2% to 77.8%, a decline of -0.4%. Over the coming week, we'll be

watching: in Canada, March industrial prices (Tuesday) and February retail

sales (Friday); in the U.S., March new home sales and building permits

(Wednesday), March durable goods orders (Thursday) and the University of

Michigan consumer sentiment index (Friday). Elsewhere in the world, we'll be

keeping an eye on Standard and Poor's Purchasing Managers' Indices for Japan

and the Eurozone, and on Eurozone international trade data for February.

Four of the six stock markets we follow ended the week higher. The Tokyo

Stock Exchange posted the biggest gain, up 3.4%. The Toronto and Paris stock

exchanges followed with gains of 2.6%; the Canadian stock market benefited

particularly from the strong performance of metals and oil. The Shanghai Stock

Exchange advanced by 1.2%, and seems to be faring better than the US bourses.

The only two stock exchanges to fall were the American ones: the New York Stock

Exchange was down -1.5% and the NASDAQ 100 was down -2.3%.

Yields on 10-year government bonds are down for the four top-rated

countries we track. Lower yields mean higher bond prices, given the inverse

relationship between yields and bond prices. U.S. bond yields, the market's

main benchmark, are down -16 bps at 4.33% (1 basis point or bps = 0.01%). The

Canadian bond yield is also down -13 bps, leaving the Canadian rate 119 bps

lower than the U.S. rate. Germany's bond yield fell by -10 bps to 2.47%.

Japan's bond yield fell by -3 bps to 1.31%.

On the commodities market, three of the four commodities we follow are

up. Copper jumped 5.9%, as several favorable developments in red metal

production were announced during the week. Oil rises sharply by 5.2% as US

companies abandon renewable energy projects. Gold is up 2.8% to close above

3,300 USD for the first time. Corn was the only commodity to fall, down -1.4%.

In the crypto-currency sector, the two cryptos we follow are up: bitcoin

by 0.8% and ethereum by 1.2%.

On April 18, it cost

0.3¢ CAD less to buy one US dollar than on April 11. The euro and yen are also

rising against Uncle Sam's dollar: the single European currency by 0.3% and the

Japanese currency by 1.0%.

See the detailed table by following this link:

https://iclf.ca/DL/BTTT_sommaire_marches_250418.pdf

Paul Bourget

Project Director, Bourstad

CIRANO

paul.bourget@cirano.qc.ca

About CIRANO (www.cirano.qc.ca )

The Center for

Interuniversity Research and Analysis of Organizations (CIRANO) is a

multidisciplinary, liaison and transfer research center, whose mission is to

accelerate the transfer of knowledge between the research community and users

in industry and public services.

About BOURSTAD (www.bourstad.ca )

The Bourstad program

is an activity of the Center for Interuniversity Research and Analysis of

Organizations (CIRANO) which receives support from many partners for this

financial education project: the Autorité des marchés financiers, its main partner,

TD Bank, CFA Montreal , the Canadian Investment

Regulatory Organization (CIRO), Les Affaires, Finance Montreal, TMX Group,

Hyprasoft, Groupe Investissement responsable

and QuoteMedia.